Table of Content

You're refinancing a residential property for up to 80% of its current value. I had a fantastic experience dealing with Reduce Home Loans who provided finance for my SMSF to purchase an investment property in July 22. I was particularly impressed with Bryce Stimpson's helpfulness, knowledge, responsiveness, professionalism and pleasantness.

This will enable you to access the funds in the future with greater ease. Of course if you access the funds you have paid into your offset account then you will lose the benefit from making your additional repayments. Yes, making additional repayments to a 100% offset account will have the same effect as if you had made the extra repayments to your loan account.

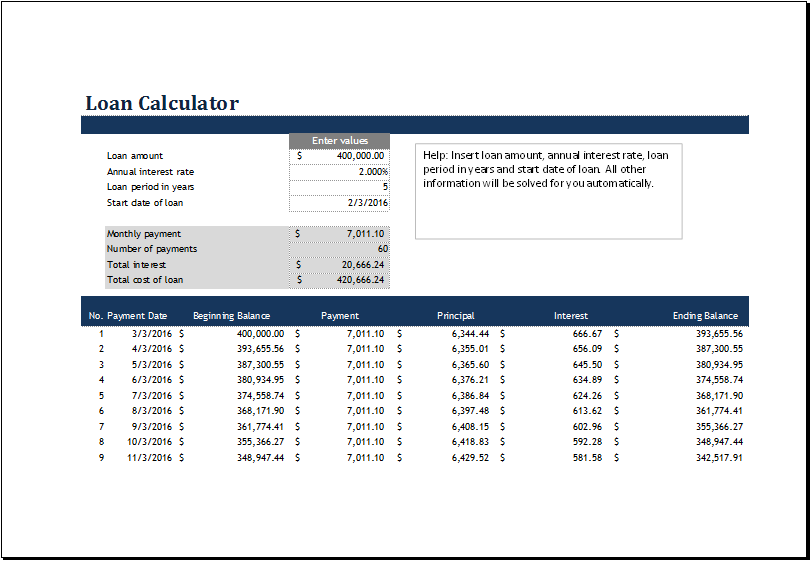

Mortgage Repayment Calculator

By paying extra, you could reduce your loan term by 0 year 0 month and save $0.00 in interest. If you’re making interest only repayments then you’re only paying down the interest on your loan for a set period of time, usually one to five years. When you repay interest only, the total amount borrowed will not reduce. Use our extra repayment calculator to see how much quicker you can own your property outright. Budget calculator will also help you work out how much additional repayments you can make towards your loan.

To also run scenarios for new payments by changing the loan term try Loan Repayment Calculator. To find out more about how an offset account works or to calculate your average offset balance please see our offset account calculator page. Applications are subject to credit approval, satisfactory security and minimum deposit requirements. Full terms and conditions will be set out in our loan offer, if an offer is made. With an offset account attached to your loan, you can reduce the amount of interest you pay.

Mortgage Calculator With Extra Payments

Calculate how much you can save with regular deposits in a savings account accruing interest over time. The Federal Reserve has hinted they are likely to taper their bond buying program later this year. However, you don't have to pay that much to make an impact. Even paying $20 or $50 extra each month can help you to pay down your mortgage faster. A home loan with a variable interest rate and low fees. Orange One Low Rate Low rate credit card with no annual fee.Orange One Rewards Platinum Platinum credit card with cashback rewards.

Our home loan extra repayment & lump sum payment calculator can show you just how much difference extra repayments can make to your overall loan. This page will tell you how much you can save by making extra repayments into your offset account. Paying off your mortgage early may save you thousands of dollars in interest and may shave years off of your mortgage. It may be worth considering paying off your mortgage early if your lender allows for extra repayments without penalty.

How the extra and lump sum calculator works

There are a few factors that determine how quickly you can pay off your mortgage – your loan size, your loan term, your interest rate and your loan features. If you want to pay your home loan debt sooner, you may want to consider choosing a loan that allows for extra repayments without penalty. Making extra payments is one of the easiest ways to get on top of your debt quicker than your loan term. The main benefit of paying extra on a home mortgage or personal loan is saving money. When a borrower consistently makes additional payments, he could save thousands of dollars on his loan.

Paying extra toward your mortgage may not make sense if you aren't planning to stay in your home for more than a few years. You won't pay down your equity fast enough to make it worth your while if you are planning to move in less than five to 10 years. You should also carefully evaluate the trends in your local housing market before you pay extra toward your mortgage. Applications for finance are subject to the Bank’s normal credit approval. Full terms and conditions are included in the Loan Offer. With some of the lowest interest rates on the market for owner occupiers.

Since 1995 we've been helping Australians learn about home ownership, compare home loans and get help from home loan specialists to find the right home loan for them. Interest is calculated daily and raised monthly on your due date every month. The extra amount of money you will contribute to your loan. No application fees, no account-keeping fees, no annual fees.

Whether you can contribute one larger lump sum or extra repayments over time will depend on you. Additional repayments will be made on top of your standard monthly repayment of $100 each month. An extra $10,000 will be contributed in the sixth month of your loan term. We can help you understand how your repayments could change if you choose to pay principal and interest or interest only, as well as how much you could save by making extra repayments. The extra repayment calculator will work out the length of your new mortgage term and the total amount that you will save.

Use our extra repayments calculator to see what this could look like for you. All Personal Loans Unsecured personal loan with a low fixed rate, no ongoing monthly fees and no early repayment fees. Calculate mortgage expenses such as home loan applications, monthly repayments, property management and more. For example, if you had a loan balance of $400,000 and an offset account with $50,000 in it, you would only need to pay interest on $350,000. This can help you pay down your mortgage faster, without needing to constantly make extra contributions. Plus, the money can be accessed if you need it, and more money can be deposited into the account whenever you want to.

Orange Everyday Youth bank account Helping teens aged 15 to 17 to start out right. Book an appointment Book instantly to speak to a Home Loan Specialist about a new loan at a time that suits you. CommBank has partnered with Home-in, your personal home buying concierge, simplifying complex processes and helping you in every step of your home buying journey. Find your perfect property sooner with market estimates and affordability snapshots. Want to know more about a property or an area you’re considering buying or selling in? Your complimentary Property Report is customised to your needs, with the latest information on new listings, auctions and recent sales.

An easy way to make your money work for you is to put it towards your mortgage in additional and lump-sum payments. It’s a tool that can help you identify the truer cost of a loan. It’s calculated using a standard formula that includes the interest rate, as well as certain fees and charges relating to a loan .

No comments:

Post a Comment