Table of Content

Comparison rates for variable Interest Only loans are based on an initial 5-year Interest Only period. Comparison rates for fixed or guaranteed Interest Only loans are based on an initial Interest Only period equal in length to the fixed or guaranteed period. 2Rate/s apply to new lending only and may include a margin below or above the applicable reference rate.

You will pay $233,133.89 in interest over the course of the loan. If you pay an additional $50 per month, you will save $21,298.29 in interest over the life of the loan and pay off your loan two years and four months sooner than you would have. Loan and age eligibility requirements and other limitations and exclusions may apply. But what if there was a way to reduce the length of your home loan, and save on interest? By making an extra lump sum payment off your loan, you can.

Rate hikes spike interest in fixed rate mortgages

Off the Home Owners Dream reverted variable rate will automatically apply after the 5th anniversary of the loan. These fees and loyalty discount are factored into the comparison rate. For the Home Owners Dream 3 year fixed where the borrower pays an upfront fee of $697 then a corresponding loyalty discount of 0.20% p.a. For the Wealth Maximizer 2 year fixed where the borrower pays an upfront fee of $697 then a corresponding loyalty discount of 0.20% p.a. Off the Wealth Maximizer reverted variable rate will automatically apply after the 5th anniversary of the loan. For the Wealth Maximizer 3 year fixed Principal & Interest where the borrower pays an upfront fee of $697 then a corresponding loyalty discount of 0.20% p.a.

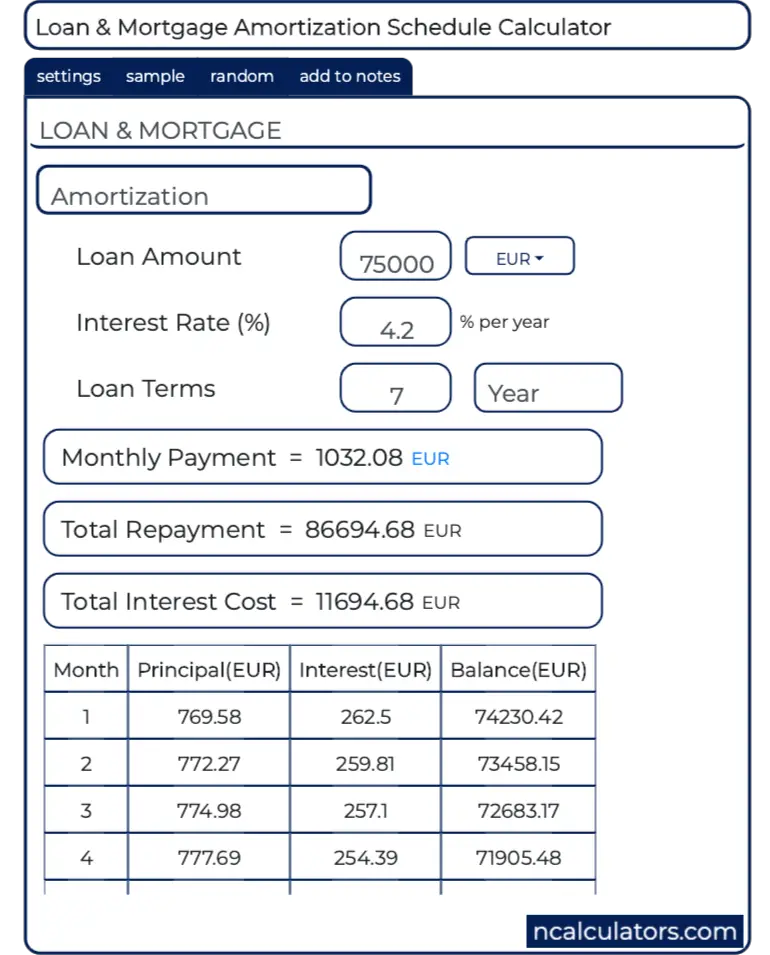

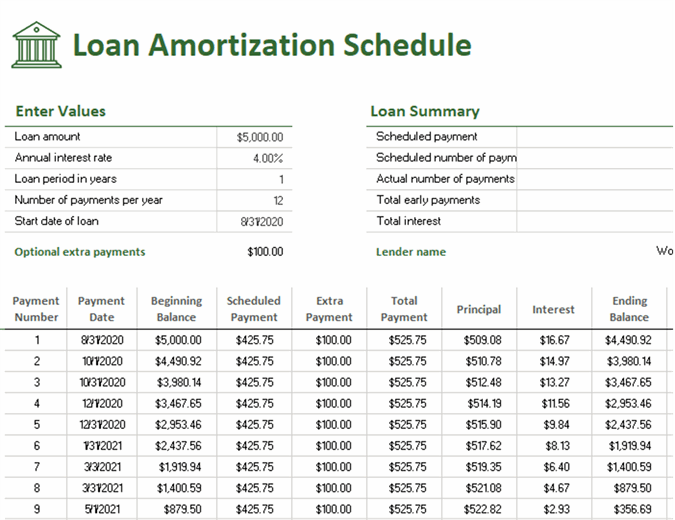

Let's take a look at an example of how much extra payments can save on a loan of $150,000 with an interest rate of 5.5% and a 10-year term. But remember, some loans don’t allow you to make additional repayments or have limits on the extra repayments you can make. Reduce Home Loans offers fixed loans with extra repayments available up to $20,000 per anniversary year during the fixed period. After the fixed period expires, the rate reverts to variable and unlimited extra repayments and redraw apply. The amount you can save with extra home loan repayments depends on your home loan size, loan term and interest rate. Use the above mortgage over-payment calculator to determine your potential savings by making extra payments toward your mortgage.

NSW Stamp Duty Calculator 2022: Property Transfer Duty

Interest Only payments available for up to 5 years for Owner Occupied Home Loans and up to 10 years for Investment Home Loans1. The product discount margin will vary depending on the Loan to Value Ratio . SMSF Term Deposit High fixed interest rate for your Self Managed Superannuation Fund. SMSFSMSF Cash High variable interest rate on the cash component of your Self Managed Superannuation Fund. Personal SavingsAll personal savings Get ahead or stay that way with an ING savings account.

Alternatively, you can reduce your repayments to free up some cash, provided we’ve reduced the interest rate or you’ve gotten ahead on your loan by making additional repayments. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. We also offer three other options you can consider for other additional payment scenarios. Making repayments above your minimums could make a big difference to how quickly you could pay off your home loan.

See all home loan interest rates

Work out your budget based on household and lifestyle expenses, to get an idea of how much you may be able to afford in repayments. Start planning now to save time later in your home buying journey with our home loan tools and calculators. See how splitting your home loan between fixed and variable interest rates could work for you. Use these mortgage calculators to guide you in your home ownership journey.

These can help you do your sums about different aspects of borrowing to buy a property, such as how much you can afford to borrow and how much your repayments will be. Extra repayments on a mortgage are any payments you make on top of the minimum regular repayment amount that is listed on your home loan contract. Also the more you repay, the quicker you’ll pay off the loan.

Offering a change of pace from Australia’s mecca, the sun, sand and surf offered by the Central Coast remain an enticing... Australia’s most prolific property market bore the brunt of declines in 2022, yet opportunities remain in the following ... Often considered the ‘little brother’ to capital city markets, regional property markets have held up stronger throughou... Try our personal budget calculator to help plan your weekly expenses. Our award-winning mortgage brokers will find you the right home loan for your needs.

It cannot be established in the name of a business or family investment trust. Trust loans can however be linked to the trustee package where the trustee is an applicant (i.e. the borrower) on the loan. For example, a loan held in the name of “John Smith ITF The Smith Family Trust” can have a package established in the name of John Smith as the trustee. Estimate the other costs of buying a property, including government costs, stamp duty, and fees. Digital lender Athena has altered its variable home loan products, launching ‘Straight Up’ and ‘Power Up’ home loans.

This will depend on how large your extra repayments are and how frequently you are making them. Let’s look at another quick example to demonstrate how quickly your mortgage can be paid off with additional repayments. Let’s say you have a $400,000 home loan with a 3% interest rate over a 30-year loan term. Without making extra or lump sum repayments, you’d need to make $1,686.42 monthly repayments. By adding $300 extra monthly repayments from month one, and contributing a $20,000 lump sum amount after two years, you would slice eight years and two months off the life of your loan. For the Home Owners Dream 2 year fixed where the borrower pays an upfront fee of $697 then a corresponding loyalty discount of 0.20% p.a.

Essential tools and tips on everything from buying to investing in property. Unloan acknowledges the Traditional Owners of the lands across Australia as the continuing custodians of Country and Culture. We pay our respect to First Nations peoples and their Elders, past and present. One low rate, with a discount that gets better and better. Documents to verify your income When you apply for an Unloan home loan, you'll need to provide documents to verify your income.

Compare rates, features and fees across all our home loans in this easy table. If your circumstances do change, and you think you’ll find it difficult to meet your required repayments, we can help. You might also want to consider aligning your repayment date to a few days after you get paid to avoid missing repayments.

An easy way to make your money work for you is to put it towards your mortgage in additional and lump-sum payments. It’s a tool that can help you identify the truer cost of a loan. It’s calculated using a standard formula that includes the interest rate, as well as certain fees and charges relating to a loan .

SA Stamp Duty Calculator: Property Transfer Duty

Increasing the frequency of your repayments can help you pay less interest over the life of the loan. You can also make one-time payments toward your principal with your yearly bonus from work, tax refunds, investment dividends or insurance payments. Any extra payment you make to your principal can help you reduce your interest payments and shorten the life of your loan. Business Optimiser High variable interest business savings account with 24/7 access.Business Term Deposit High fixed interest rate for business savings. You choose the timeframe.Wholesale Term Deposit Competitive interest rates for a fixed period, that's tailored to your cash flow needs.

This will enable you to access the funds in the future with greater ease. Of course if you access the funds you have paid into your offset account then you will lose the benefit from making your additional repayments. Yes, making additional repayments to a 100% offset account will have the same effect as if you had made the extra repayments to your loan account.

No comments:

Post a Comment